High-Integrity Pressure Protection System (HIPPS) Market Size, Share, Statistics and Industry Growth Analysis Report by Component (Field Initiator, Logic Solver, Valves, Actuators), Service (Maintenance, TIC), Industry (Oil & Gas, Chemical) and Region (2025-2030)

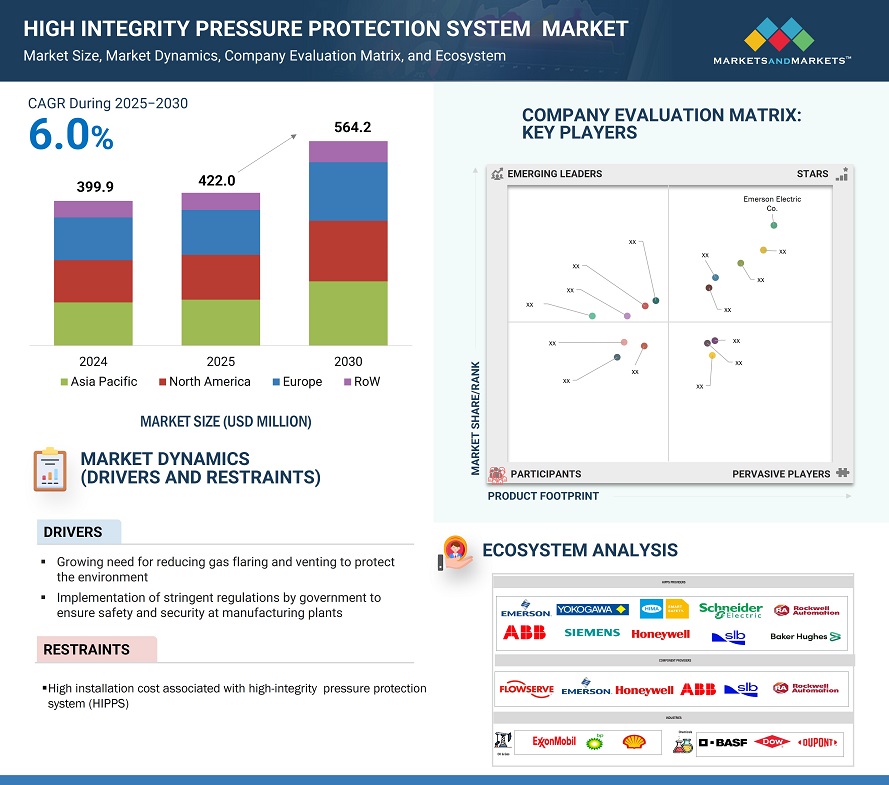

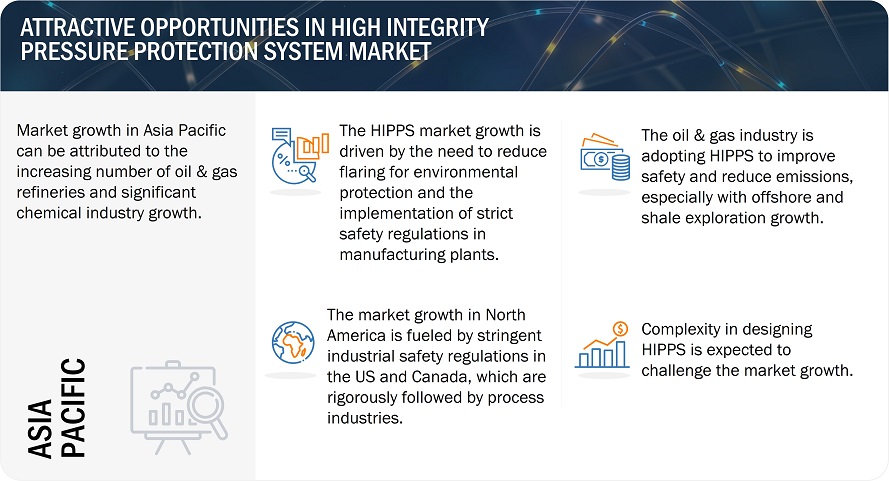

The global High Integrity Pressure Protection System market is anticipated to grow from USD 422.0 million in 2025 to USD 564.2 million by 2030, recording a CAGR of 6.0% during 2025–2030. Increasing environmental concerns and the need to reduce gas flaring and venting in industrial processes. Stringent government regulations to ensure safety and prevent overpressure incidents in manufacturing plants further drive adoption across industries like oil & gas and chemicals. Additionally, the expansion of refineries and petrochemical plants, coupled with the growing use of industrial IoT for smarter, more efficient safety systems, creates new growth opportunities.

To know about the assumptions considered for the study, Request for Free Sample Report

High Integrity Pressure Protection System (HIPPS) Market Dynamics

Driver: Growing need for reducing gas flaring and venting to protect environment

Gas flaring is usually carried out at oil and gas production sites during scheduled maintenance, equipment repair, or shutdown events. The technique allows controlled pressure release from the gas collection and processing systems. Thus, it is used to maintain pressures and ensure safe and efficient operations within industrial plants. However, currently, gas flaring has become one of the major concerns in process industries as it burns valuable natural resources and produces a large amount of carbon dioxide, sulfur dioxide, and nitrous oxide gases, which adversely affect the environment. Similarly, gas venting is also carried out to maintain safety during different stages of the treatment process. In this procedure, unburnt gases (impure gases) are released into the atmosphere, which can adversely affect human health. To counter the issues associated with gas flaring and venting, oil and gas manufacturers are using floating liquefied natural gas (FLNG) vessels for zero hydrocarbon gas flaring under normal operating conditions. In addition, the HIPPS is deployed at the FLNG gas inlet to shut down the gas flow during over-pressurization events, thereby reducing the requirement of flaring. HIPPS is a reliable safety instrumented system (SIS) used to prevent catastrophic over-pressurization and release of toxic, explosive, and flammable chemicals.

Restraint: High installation cost associated with high-integrity pressure protection system (HIPPS)

The HIPPS is an integration of several safety products, which include pressure transmitters, logic solvers, field initiators, and the final elements, which are valves and actuators. This is mounted primarily to protect employees, machines and flow lines in case of an unfortunate event. However, the costs associated with HIPPS components, installation, maintenance, and repair add a substantial burden on organizations’ budgets. Although large organizations can manage these expenses, it can be difficult for medium- and small-sized organizations. In addition, HIPPSs need to comply with regulatory standards that are frequently updated according to technological advancements and new mandates, resulting in the requirement on organizations to upgrade their safety systems. This requires additional investments in the deployment of safety components and systems.

Opportunity: Focus of market players on offering improved customer services

HIPPS providers emphasize creating trust with clients by identifying customers’ needs and solving problems effectively. With competition stiffening up, they shift focus to issues like maintenance and repair to make a push towards the competition. For instance, Emerson enhances responsiveness and productivity by offering tailored components, comprehensive service-level agreements, and advanced diagnostics. These proactive measures help reduce operational disruptions, including unplanned downtime and maintenance costs. HIPPS providers go beyond maintaining system components to deliver effective solutions and strive to understand their customers' unique processes. Industry leaders like Emerson, Yokogawa, and HIMA leverage their extensive maintenance expertise and innovative strategies to address client priorities and concerns, ensuring superior service delivery. Industries such as oil & gas, energy & power, and chemicals often require immediate support to address critical applications. This demand for prompt and reliable service presents an opportunity for HIPPS manufacturers to strengthen customer loyalty and enhance their market presence. By aligning services with customer requirements and delivering timely solutions, providers can foster trust, improve satisfaction, and maintain a competitive position in the evolving HIPPS market.

Challenge: Complexity in designing of HIPPS

To build a strong relationship with clients, many HIPPS providers focus on meeting their requirements and identifying and effectively addressing their issues. Gradually, the market is becoming more competitive; therefore, HIPPS providers give more importance to providing services such as system maintenance and repair that enable them to achieve a competitive edge. For instance, Emerson’s technical support services include manufacturing tailor-made components and adding them to the service-level agreements to improve responsiveness and productivity, along with providing system reports and diagnostics. Providing proactive support to match customers’ needs allows them to eliminate disruptions such as unplanned maintenance and downtime costs.

Services in the HIPPS market is not limited to maintaining the system’s components. The providers need to know the customers’ processes to offer products and services appropriate for their processes and requirements. A few of the key industry players, such as Emerson, Yokogawa, and HIMA, are working on utilizing their vast maintenance experience and smart methods while keeping their customers’ concerns, priorities, and needs in mind for providing better services.

Certain critical applications in industries such as oil & gas, energy & power, and chemical require immediate customer service support to rectify the problems. This, in turn, provides an opportunity for the manufacturers to retain customers and boost their market position by providing appropriate and prompt services.

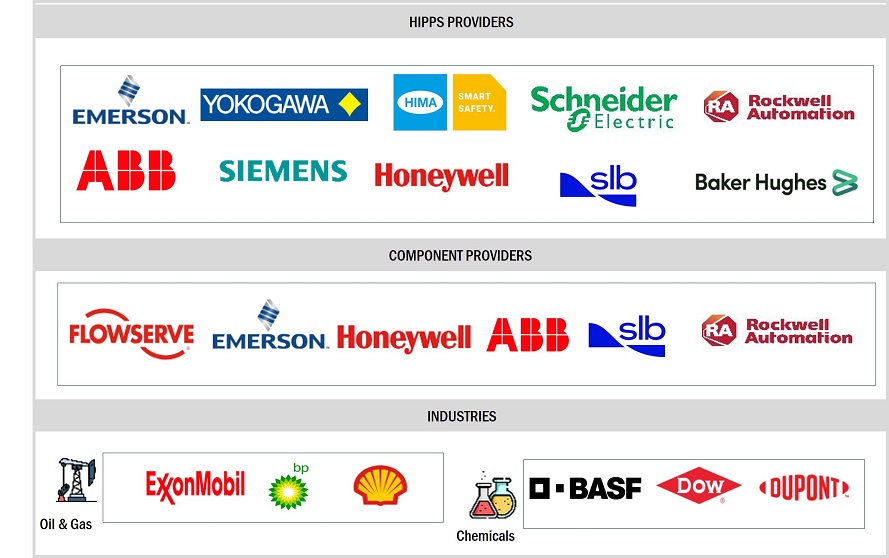

High Integrity Pressure Protection System (HIPPS) Ecosystem

The High-Integrity Pressure Protection System (HIPPS) ecosystem encompasses a collaborative network of component manufacturers, system providers, service providers, and end-users, all working to ensure safety and operational efficiency in high-pressure environments. It integrates advanced components like sensors, valves, and logic solvers, supported by lifecycle services and digital solutions. With critical applications in industries such as oil & gas, chemicals, and power generation, the ecosystem ensures compliance with safety standards while addressing industry-specific needs.

Market for testing, inspection, and certification services to grow at fastest CAGR from 2025 to 2030

The adoption of High-Integrity Pressure Protection Systems (HIPPS) in greenfield projects is increasing, significantly boosting the demand for related services. These services are crucial in enhancing and extending the operational life of HIPPS by ensuring they function reliably over time. Regular testing, inspection, and certification are fundamental to maintaining the system's integrity and safety. These services help identify any discontinuities, defects, or faults that may compromise the system's performance and increase the risk of failure. Maintenance plays an essential role in the overall lifecycle of HIPPS, as it ensures the system continues to operate at its optimal level throughout its life. Proper maintenance is also vital for retaining the system’s designed Safety Integrity Level (SIL) rating, a key measure of safety performance. Maintaining the HIPPS in good working condition helps prevent costly failures and downtime, thereby reducing operational risks. As a result, the demand for HIPPS-related services, especially maintenance and certification, is growing as industries seek to safeguard their operations and extend the lifespan of their systems in high-risk environments like oil & gas, chemicals, and power generation.

Oil & gas accounted for the largest share of the HIPPS market in 2024

The oil and gas sector dominated the HIPPS market, driven by the growing demand for energy, expanding transportation infrastructure, and increased drilling activities in Gulf Cooperation Council (GCC) countries. Given the high-risk nature of oil extraction and offshore drilling, High-Integrity Pressure Protection Systems (HIPPS) is crucial to ensure safety and mitigate potential hazards. As new projects are launched and existing oil extraction operations expand, the demand for HIPPS is expected to rise significantly in the coming years. The continued growth of the oil and gas industry, coupled with the need for enhanced safety measures in high-pressure environments, will further emphasize the importance of HIPPS. These systems are vital in safeguarding personnel, preventing equipment damage, and protecting the environment, especially in hazardous extraction operations. As the industry evolves, the integration of HIPPS will remain a critical factor in reducing operational risks and ensuring compliance with stringent safety regulations, fueling the continued growth of the HIPPS market in the foreseeable future.

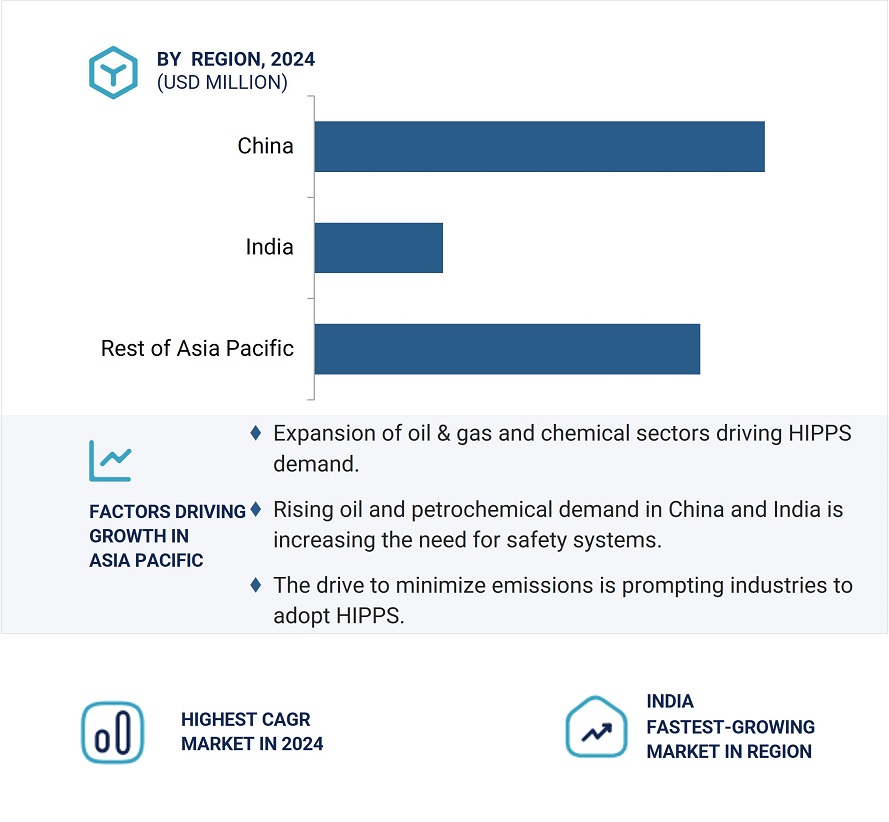

Asia Pacific to record highest CAGR in global HIPPS market during forecast period

The HIPPS market in the Asia Pacific region is anticipated to grow at the highest CAGR due to the rising number of oil and gas refineries and substantial chemical industry growth. Asia Pacific offers significant potential for installing HIPPS in key sectors such as oil & gas and chemicals. The increasing demand for petrochemicals in countries like China and India is driving the production of oil, gas, and chemicals in the region. As these industries expand, there is a growing need for safety systems like HIPPS to mitigate risks and ensure operational reliability. The oil and gas industry is expected to surge in demand for HIPPS, with numerous greenfield projects planned in emerging markets like India and China. This expansion in the oil & gas sector and the region's industrial growth will further fuel the demand for advanced safety solutions like HIPPS, ensuring that operations are safe and compliant with international standards. As a result, the Asia Pacific region will continue to be a key growth driver for the HIPPS market in the coming years.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- Emerson Electric Co. (US)

- Yokogawa Electric Corp. (Japan)

- HIMA (Germany)

- Schneider Electric (France)

- Rockwell Automation Inc. (US)

- ABB (Switzerland)

- Schlumberger (US)

- Siemens (Germany)

- Honeywell International (US)

- Baker Hughes (US)

- Mokveld (Netherlands)

- Velan (Canada)

- IMI (UK)

- L&T Valves (India)

- Samson AG (Germany)

Scope of the Report

|

Report Metric |

Detail |

|

Market Size Availability for Years |

2025–2030 |

|

Base Year |

2021 |

|

Forecast Period |

2025–2030 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By offerings, type, and industry |

|

Geographies Covered |

North America, Europe, APAC, Middle East, and RoW |

|

Companies Covered |

Emerson Electric Co. (US), Yokogawa Electric Corp. (Japan), HIMA (Germany), Rockwell Automation Inc. (US), Schneider Electric (France), Honeywell International (US), ABB (Switzerland), Siemens (Germany), Schlumberger (US), and Baker Hughes (US) are the key players in the HIPPS market. A total of 25 players are covered. |

This research report categorizes the HIPPS market, by type, offering (components and services), industry, and region

Based on the types:

- Electronic HIPPS

- Mechanical HIPPS

Based on the Components:

- Field Initiators

-

Logic Solver

- Solid State

- Others

-

Final Element

- Actuators

- Valve

- others

Based on the Services:

- Testing, Inspection and Certification

- Maintenance

- Training and Consultation

Based on end-user industry:

- Oil & Gas

- Chemicals

Based on the region:

- North America

- Europe

- APAC

- Middle East

- RoW (South America, & Africa)

Recent Developments

- In May 2024, IMI launched a high integrity pressure protection system (HIPPS) to safeguard against overpressure in hydrogen post-production. This system isolates high pressure, enhancing safety and uptime while supporting the hydrogen value chain.

- In November 2023, HIMA Group established HIMA Saudi Arabia to enhance safety and support Saudi Arabia’s Vision 2030 and IKTVA program. With over 100 years of expertise, HIMA aims to provide tailored solutions to improve efficiency and compliance.

- In October 2021, Emerson launched the first comprehensive valve assemblies that fulfill safety integrity level (SIL) 3 as per the IEC 61508 standard of the International Electrotechnical Commission.

- In September 2021, Yokogawa launched its new Electric Exaquantum Safety Function Monitoring (SFM) software, a solution to identify whether actual operating performance meets safety design targets. The new version of the software supports the International Electrotechnical Commission (IEC) 61511 standard and includes several new features to help SFM users identify potential safety issues, optimize maintenance activities, and improve overall safety solution design.

Frequently Asked Questions (FAQ):

Which are the major companies in the HIPPS market? What are their major strategies to strengthen their market presence?

The major companies in the HIPPS market are - Emerson Electric Co. (US), Yokogawa Electric Corp. (Japan), HIMA (Germany), Rockwell Automation Inc. (US), Schneider Electric (France), Honeywell International (US), ABB (Switzerland), Siemens (Germany), Schlumberger (US), and Baker Hughes (US). Players in this market have adopted product launches and developments strategy to increase their market share.

Which is the potential market for HIPPS regarding the region?

North America held the largest share of the HIPPS market in 2024.

What are the opportunities for new market entrants?

Expansion of refineries and petrochemical plants and surging demand for unconventional petrochemicals, shale oil, and gas is forcing the US to increase oil production in the coming years. This is expected to result in the expansion of refineries and petrochemical plants to increase production capacities, thereby fueling the demand for safety systems in the region. IIoT is creating new opportunities for integrated safety and compliance services. IIoT can acquire data from sensors that measure pressure, level, flow, temperature, and vibration and send it to monitoring systems.

Which end-user industries are expected to drive the growth of the market in the next five years?

Major end-user industries for the HIPPS market include - oil & gas and chemicals.

Which type of HIPPS is expected to hold the largest share of the market by 2030?

Electronic HIPPSs are widely used in various end-user industries as they are offer additional functionalities of data acquisition and diagnosis compared to mechanical HIPPS. It is also easier for inspection and troubleshooting during an error.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HIPPS MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 HIPPS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.1.3.3 Key insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 SUPPLY SIDE ANALYSIS: MARKET (1/2)

FIGURE 4 SUPPLY SIDE ANALYSIS: MARKET (2/2)

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENTS

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 8 HIPPS MARKET SIZE, 2018–2027

FIGURE 9 MARKET FOR SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 10 OIL & GAS INDUSTRY TO ACCOUNT FOR LARGER SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA TO BE DOMINANT MARKET FOR HIPPS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 12 GROWING NEED FOR REDUCING FLARING TO PROTECT ENVIRONMENT TO DRIVE GROWTH OF MARKET

4.2 HIPPS MARKET, BY OFFERING

FIGURE 13 COMPONENT SEGMENT TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

4.3 MARKET IN NORTH AMERICA, BY COUNTRY AND INDUSTRY

FIGURE 14 US AND OIL & GAS INDUSTRY TO ACCOUNT FOR LARGEST SHARES OF NORTH AMERICAN MARKET IN 2027

4.4 MARKET, BY COUNTRY

FIGURE 15 US TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 HIPPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing need for reducing gas flaring and venting to protect environment

5.2.1.2 Implementation of stringent regulations by governments to ensure safety and security at manufacturing plants

FIGURE 17 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High installation cost associated with high-integrity pressure protection system (HIPPS)

FIGURE 18 MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Expansion of refineries and petrochemical plants

5.2.3.2 Focus of market players on offering improved customer services

5.2.3.3 Growing usage of Industrial Internet of Things (IIoT)

FIGURE 19 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Complexity in designing of high-integrity pressure protection system (HIPPS)

FIGURE 20 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 HIPPS: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 22 HIPPS ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 23 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN HIPPS MARKET

5.6 CASE STUDY ANALYSIS

5.6.1 IMI CRITICAL OFFERED COST-EFFECTIVE SOLUTION TO OIL & GAS COMPANY IN LATIN AMERICA

5.6.2 YOKOGAWA DEMONSTRATED INSTALLATION OF HIPPS IN SUB-SEA CAN DRASTICALLY REDUCE OPERATIONAL COST

5.6.3 SELLA CONTROLS INSTALLED SKID-MOUNTED HIPPS AT LNG TERMINAL IN INDIA

5.7 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICES OF COMPONENTS OF HIPPS OFFERED BY TOP COMPANIES, 2021

TABLE 3 INDICATIVE PRICES OF COMPONENTS OF HIPPS

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 IMPACT OF EACH FORCE ON MARKET

5.9 TECHNOLOGY ANALYSIS

5.9.1 SOFTWARE-BASED SIS SOLUTION

5.10 TRADE ANALYSIS

FIGURE 24 IMPORT DATA OF HS 848140, BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 25 EXPORT DATA OF HS 848140, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENTS ANALYSIS

FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS OWNED IN LAST 10 YEARS

TABLE 5 TOP 20 PATENT OWNERS IN LAST 10 YEARS

FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2020

TABLE 6 LIST OF MAJOR PATENTS

5.12 REGULATORY LANDSCAPE

5.12.1 SAFETY INTEGRITY LEVEL (SIL)

TABLE 7 SIL AND RELATED MEASURES

5.12.2 IEC 61508

5.12.3 IEC 61511

TABLE 8 DIFFERENCE BETWEEN IEC 61508 AND IEC 61511 STANDARDS

6 HIPPS MARKET, BY OFFERING (Page No. - 59)

6.1 INTRODUCTION

FIGURE 28 COMPONENT TO BE LEADING SEGMENT IN MARKET IN 2027

TABLE 9 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 10 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 COMPONENTS

TABLE 11 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 12 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 13 MARKET FOR COMPONENT, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 14 MARKET FOR COMPONENT, BY INDUSTRY, 2022–2027 (USD MILLION)

6.2.1 FILED INITIATORS

6.2.1.1 Pressure transmitters function as field initiators for HIPPS

6.2.2 LOGIC SOLVER

6.2.2.1 Solid-state logic solver

6.2.2.1.1 Solid-state logic solver is highly preferred in many applications

6.2.2.2 Other

TABLE 15 MARKET, BY LOGIC SOLVER TYPE, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY LOGIC SOLVER TYPE, 2022–2027 (USD MILLION)

6.2.3 FINAL CONTROL ELEMENT

6.2.3.1 Valves

6.2.3.1.1 Valve is major part of HIPPS

6.2.3.2 Actuators

6.2.3.2.1 Actuators enable closing and opening functions for valves

6.2.4 OTHER COMPONENTS

6.3 SERVICES

TABLE 17 MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 19 MARKET FOR SERVICE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 20 MARKET FOR SERVICE, BY INDUSTRY, 2022–2027 (USD MILLION)

6.3.1 TESTING, INSPECTION, AND CERTIFICATION (TIC)

6.3.1.1 End users rely on testing, inspection, and certification services for examining quality of HIPPS before implementation

6.3.2 MAINTENANCE

6.3.2.1 Regular maintenance ensures efficient functionality of HIPPS over long period

6.3.3 TRAINING AND CONSULTATION

6.3.3.1 Consulting services help to offer customized systems based on requirement

7 HIPPS MARKET, BY TYPE (Page No. - 68)

7.1 INTRODUCTION

FIGURE 29 ELECTRONIC HIPPS SEGMENT ACCOUNTED FOR LARGER SHARE OF MARKET IN 2021

TABLE 21 KEY POINTS: MECHANICAL AND ELECTRONIC HIPPS

7.2 ELECTRONIC HIPPS

7.2.1 HIGH USE OF ELECTRONIC HIPPS IN INDUSTRIAL SAFETY APPLICATIONS

7.3 MECHANICAL HIPPS

7.3.1 GROWING USE OF MECHANICAL HIPPS IN EXTREME REMOTE APPLICATIONS

8 HIPPS MARKET, BY INDUSTRY (Page No. - 70)

8.1 INTRODUCTION

FIGURE 30 OIL & GAS TO BE LEADING SEGMENT IN MARKET IN 2027

TABLE 22 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

8.2 OIL & GAS

TABLE 24 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 MARKET FOR OIL & GAS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR OIL & GAS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 28 MARKET FOR OIL & GAS INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 29 MARKET FOR OIL & GAS INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 30 MARKET FOR OIL & GAS INDUSTRY IN MIDDLE EAST, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR OIL & GAS INDUSTRY IN MIDDLE EAST, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 32 MARKET FOR OIL & GAS INDUSTRY IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR OIL & GAS INDUSTRY IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 34 MARKET FOR OIL & GAS INDUSTRY IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR OIL & GAS INDUSTRY IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 MARKET FOR OIL & GAS INDUSTRY, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR OIL & GAS INDUSTRY, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 38 TYPICAL APPLICATIONS OF HIPPS IN UPSTREAM, MIDSTREAM, AND DOWNSTREAM SECTORS

TABLE 39 MARKET FOR OIL & GAS INDUSTRY, BY STREAM TYPE, 2018–2021 (USD MILLION)

TABLE 40 MARKET FOR OIL & GAS INDUSTRY, BY STREAM TYPE, 2022–2027 (USD MILLION)

8.2.1 UPSTREAM

8.2.1.1 Upstream sector held largest size of market for oil & gas industry in 2021

8.2.2 MIDSTREAM

8.2.2.1 Increasing number of oil and gas pipelines to fuel demand for HIPPS in midstream sector

8.2.3 DOWNSTREAM

8.2.3.1 Increasing demand for HIPPS from LNG regasification plants in downstream sector to drive market growth

8.3 CHEMICAL

8.3.1 STRINGENT REGULATIONS AND STANDARDS TO FUEL DEMAND FOR HIGH-INTEGRITY PRESSURE PROTECTION SYSTEM (HIPPS) IN CHEMICAL INDUSTRY

TABLE 41 HIPPS MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 43 MARKET FOR CHEMICAL INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR CHEMICAL INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 45 MARKET FOR CHEMICAL INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR CHEMICAL INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 47 MARKET FOR CHEMICAL INDUSTRY IN MIDDLE EAST, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR CHEMICAL INDUSTRY IN MIDDLE EAST, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 49 MARKET FOR CHEMICAL INDUSTRY IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 50 MARKET FOR CHEMICAL INDUSTRY IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 51 MARKET FOR CHEMICAL INDUSTRY IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 MARKET FOR CHEMICAL INDUSTRY IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 MARKET FOR CHEMICAL INDUSTRY, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 54 MARKET FOR CHEMICAL INDUSTRY, BY OFFERING, 2022–2027 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 84)

9.1 INTRODUCTION

FIGURE 31 HIPPS MARKET: GEOGRAPHIC SNAPSHOT

TABLE 55 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 32 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 57 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 59 MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 60 MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US to hold largest share of North American market during forecast period

TABLE 61 MARKET IN US, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 62 MARKET IN US, BY INDUSTRY, 2022–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Expansion of pipeline networks for gas transportation to boost Canadian market growth during forecast period

TABLE 63 HIPPS MARKET IN CANADA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 64 MARKET IN CANADA, BY INDUSTRY, 2022–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Mexico to witness moderate growth in market during forecast period

TABLE 65 MARKET IN MEXICO, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 66 MARKET IN MEXICO, BY INDUSTRY, 2022–2027 (USD MILLION)

9.3 EUROPE

FIGURE 33 SNAPSHOT OF MARKET IN EUROPE

TABLE 67 MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 68 MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (USD MILLION)

9.3.1 RUSSIA

9.3.1.1 Planned investments in oil & gas industry to boost Russian market growth

9.3.2 NORWAY

9.3.2.1 Increasing oil and gas subsea exploration activities to boost market growth in Norway

9.3.3 UK

9.3.3.1 UK to be major market for HIPPS in Europe

9.3.4 REST OF EUROPE

9.4 MIDDLE EAST

TABLE 69 HIPPS MARKET IN MIDDLE EAST, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 70 MARKET IN MIDDLE EAST, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 71 MARKET IN MIDDLE EAST, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 72 MARKET IN MIDDLE EAST, BY INDUSTRY, 2022–2027 (USD MILLION)

9.4.1 SAUDI ARABIA

9.4.1.1 High oil & gas production is driving market growth in Saudi Arabia

TABLE 73 MARKET IN SAUDI ARABIA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 74 MARKET IN SAUDI ARABIA, BY INDUSTRY, 2022–2027 (USD MILLION)

9.4.2 UAE

9.4.2.1 Growing adoption of automation technologies in oil & gas production to drive growth of UAE market

TABLE 75 MARKET IN UAE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 76 MARKET IN UAE, BY INDUSTRY, 2022–2027 (USD MILLION)

9.5 ASIA PACIFIC

FIGURE 34 SNAPSHOT OF HIPPS MARKET IN APAC

TABLE 77 MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 78 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 79 MARKET IN APAC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 80 MARKET IN APAC, BY INDUSTRY, 2022–2027 (USD MILLION)

9.5.1 CHINA

9.5.1.1 Growing demand for HIPPS in oil & gas and chemical industries to fuel market growth in China

TABLE 81 MARKET IN CHINA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 82 MARKET IN CHINA, BY INDUSTRY, 2022–2027 (USD MILLION)

9.5.2 INDIA

9.5.2.1 market in India to grow at fastest CAGR during forecast period

TABLE 83 MARKET IN INDIA, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 84 MARKET IN INDIA, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

9.5.3 REST OF APAC

9.6 REST OF THE WORLD (ROW)

TABLE 85 HIPPS MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 87 MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 88 MARKET IN ROW, BY INDUSTRY, 2022–2027 (USD MILLION)

9.6.1 AFRICA

9.6.1.1 Nigeria, Algeria, and Angola to be major contributors to growth of African market

TABLE 89 MARKET IN AFRICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 90 MARKET IN AFRICA, BY INDUSTRY, 2022–2027 (USD MILLION)

9.6.2 SOUTH AMERICA

9.6.2.1 South America to hold small market share of RoW market

TABLE 91 MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 92 MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 103)

10.1 OVERVIEW

10.2 TOP FIVE COMPANY REVENUE ANALYSIS

FIGURE 35 HIPPS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2016–2020

10.3 MARKET SHARE ANALYSIS, 2021

FIGURE 36 MARKET SHARE ANALYSIS (2021)

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 STAR

10.4.2 EMERGING LEADER

10.4.3 PERVASIVE

10.4.4 PARTICIPANT

FIGURE 37 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.5 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION MATRIX, 2021

10.5.1 PROGRESSIVE COMPANY

10.5.2 RESPONSIVE COMPANY

10.5.3 DYNAMIC COMPANY

10.5.4 STARTING BLOCK

FIGURE 38 MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

10.6 HIPPS MARKET: PRODUCT FOOTPRINT

TABLE 93 COMPANY FOOTPRINT

TABLE 94 PRODUCT FOOTPRINT OF COMPANIES

TABLE 95 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 96 REGIONAL FOOTPRINT OF COMPANIES

10.7 MARKET: SME MATRIX

FIGURE 39 MARKET: DETAILED LIST OF KEY SMES

TABLE 97 MARKET: DETAILED LIST OF KEY SMES

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 MARKET: PRODUCT LAUNCHES, 2019–2021

11 COMPANY PROFILES (Page No. - 115)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1 KEY PLAYERS

11.1.1 EMERSON ELECTRIC CO.

TABLE 98 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 40 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 99 EMERSON ELECTRIC CO.: PRODUCT OFFERING

11.1.2 YOKOGAWA ELECTRIC CORPORATION

TABLE 100 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 41 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 101 YOKOGAWA ELECTRIC CORPORATION: PRODUCT OFFERING

11.1.3 HIMA

TABLE 102 HIMA: BUSINESS OVERVIEW

TABLE 103 HIMA: PRODUCT OFFERING

11.1.4 SCHNEIDER ELECTRIC

TABLE 104 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 42 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 105 SCHNEIDER ELECTRIC: PRODUCT OFFERING

11.1.5 ROCKWELL AUTOMATION INC.

TABLE 106 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 43 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

TABLE 107 ROCKWELL AUTOMATION: PRODUCT OFFERINGS

11.1.6 ABB

TABLE 108 ABB: BUSINESS OVERVIEW

FIGURE 44 ABB: COMPANY SNAPSHOT

TABLE 109 ABB: PRODUCT OFFERING

11.1.7 SCHLUMBERGER

TABLE 110 SCHLUMBERGER: BUSINESS OVERVIEW

FIGURE 45 SCHLUMBERGER: COMPANY SNAPSHOT

TABLE 111 SCHLUMBERGER: PRODUCT OFFERING

11.1.8 SIEMENS AG

TABLE 112 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 46 SIEMENS AG: COMPANY SNAPSHOT

TABLE 113 SIEMENS AG: PRODUCT OFFERING

11.1.9 HONEYWELL INTERNATIONAL INC

TABLE 114 HONEYWELL INTERNATIONAL INC: BUSINESS OVERVIEW

FIGURE 47 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

TABLE 115 HONEYWELL INTERNATIONAL INC: PRODUCT OFFERING

11.1.10 BAKER HUGHES

TABLE 116 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 48 BAKER HUGHES: COMPANY SNAPSHOT

TABLE 117 GENERAL ELECTRIC: PRODUCT OFFERINGS

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 MOKVELD

TABLE 118 MOKVELD: COMPANY OVERVIEW

11.2.2 VELAN INC

TABLE 119 VELAN INC: COMPANY OVERVIEW

11.2.3 IMI PLC

TABLE 120 IMI PLC: COMPANY OVERVIEW

11.2.4 SEVERN GLOCON GROUP

TABLE 121 SEVERN GLOCON GROUP: COMPANY OVERVIEW

11.2.5 LARSEN & TOUBRO

TABLE 122 LARSEN & TOUBRO: COMPANY OVERVIEW

11.2.6 SAMSON GROUP

TABLE 123 SAMSON GROUP: COMPANY OVERVIEW

11.2.7 MOGAS IND

TABLE 124 MOGAS IND: COMPANY OVERVIEW

11.2.8 PALADON SYSTEMS

TABLE 125 PALADON SYSTEMS: COMPANY OVERVIEW

11.2.9 PIETRO FIORENTINI S.P.A.

TABLE 126 PIERTO FIORENTINI: COMPANY OVERVIEW

11.2.10 PETROLVALVES S.P.A

TABLE 127 PETROLVALVES S.P.A: COMPANY OVERVIEW

11.2.11 BRITISH ENGINES

TABLE 128 BRITISH ENGINES: COMPANY OVERVIEW

11.2.12 PROCONTROL

TABLE 129 PROCONTROL: COMPANY OVERVIEW

11.2.13 VALVTECHNOLOGIES

TABLE 130 VALVTECNOLOGIES: COMPANY OVERVIEW

11.2.14 FRAMES GROUP

TABLE 131 FRAMES GROUP: COMPANY OVERVIEW

11.2.15 DAFRAM S.P.A.

TABLE 132 DAFRAM S.P.A.: COMPANY OVERVIEW

12 ADJACENT & RELATED MARKETS (Page No. - 150)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 INDUSTRIAL VALVES MARKET, BY FUNCTION

TABLE 133 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2017–2020 (USD BILLION)

TABLE 134 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2021–2026 (USD BILLION)

12.3.1 ON/OFF VALVES

12.3.1.1 On/off valves accounted for larger market share in 2020

12.3.2 CONTROL VALVES

12.3.2.1 Control valves to witness significant growth during forecast period

13 APPENDIX (Page No. - 153)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the High-Integrity Pressure Protection System (HIPPS) market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the HIPPS market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the HIPPS industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the HIPPS market based on offering (components and services), industry, and region. It also includes information about the key developments undertaken from both markets- and technology-oriented perspectives.

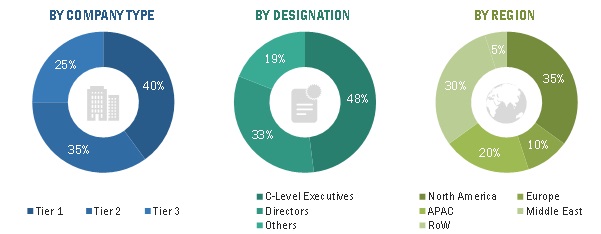

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the HIPPS market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, Middle East, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

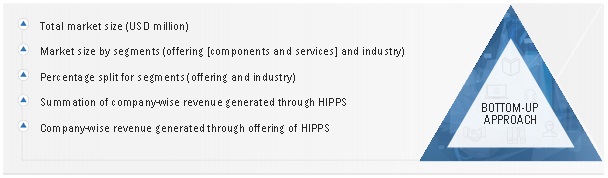

The bottom-up procedure has been employed to arrive at the overall size of the HIPPS market.

- Identifying various companies that use or are expected to deploy HIPPS at their production lines and analyzing their deployment patterns

- Estimating the size of the HIPPS market based on the demand for HIPPS in the oil & gas and chemical industries

- Conducting primary interviews with a few major players operating in the HIPPS market for validating the global market size

- Validating the market size through secondary sources, including company websites, press releases, research journals, and magazines

- Calculating the CAGR of the HIPPS market through historical and future market trend analyses by understanding the penetration rate of HIPPS and its demand and supply scenario in different industries

- Verifying the estimates at every level through discussions with key opinion leaders such as corporate executives, directors, and sales heads, as well as with the domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and databases

To know about the assumptions considered for the study, Request for Free Sample Report

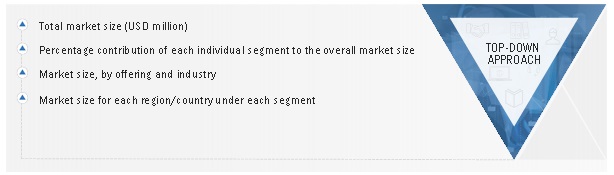

The top-down approach has been used to estimate and validate the total size of the HIPPS market.

- Information related to revenues obtained from key manufacturers and providers of HIPPS and components of HIPPS was studied and analyzed to estimate the global size of the HIPPS market.

- Revenues, geographic presence, key industries served, as well as different types of offerings of all identified players in the HIPPS market, were studied to estimate and arrive at the percentage split of the different segments of the market.

- All major players in each category (type and component) of the HIPPS market were identified through secondary research and verified through brief discussions with industry experts.

- Multiple discussions were conducted with key opinion leaders of all major companies involved in the development of HIPPS and its components to validate the market split based on offering, industry, and region.

- Geographic splits were estimated using secondary sources based on various factors, such as the number of players offering HIPPS in a specific country or region and the components offered by these players.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the HIPPS market.

Report Objectives

- To describe and forecast the HIPPS market, in terms of value, based on type, offering, industry, and region

- To forecast the market size, in terms of value, based on 5 regions—North America, Europe, Asia Pacific (APAC), Middle East, and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain of the HIPPS ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the HIPPS market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze the major growth strategies such as contracts, agreements, acquisitions, product launches, and expansions adopted by the key market players to boost their positions in the HIPPS market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in High-Integrity Pressure Protection System (HIPPS) Market